Is Your Roof Still Fully Covered by Insurance? What Delaware Homeowners Need to Know About New Roof Coverage Rules.

- joseroofusa

- Nov 2

- 6 min read

Over the past year, more Delaware homeowners have been surprised to find out that their insurance companies are quietly changing how roof coverage works.

If your roof is older — or shows signs of wear from years of wind, rain, and storms — you could soon receive a letter from your insurance carrier warning you to replace it… or risk losing coverage altogether.

At Roof USA, we’ve helped dozens of homeowners who were caught off guard by these policy updates. This guide breaks down what’s happening, why insurance companies are doing it, and what you can do right now to protect your coverage (and your wallet).

⚠️ 1. Why Insurance Companies Are Targeting Older Roofs

Insurance carriers across the U.S. — including right here in Delaware — are tightening their roof coverage standards.

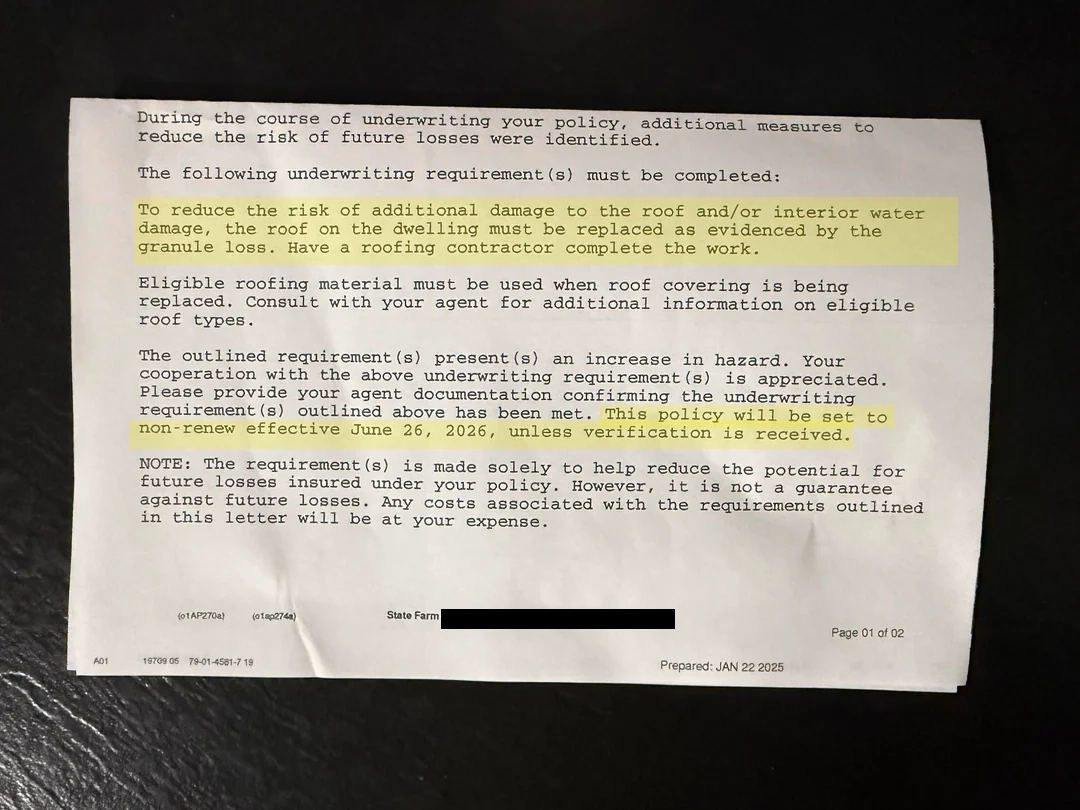

They’re using aerial imagery, weather data, and roof age information to identify homes with higher storm risk. Once flagged, many homeowners are receiving letters like:

“Your roof appears to be near the end of its useful life. Please provide proof of replacement to maintain coverage.”

In other words: Even if your roof isn’t leaking, your insurer might consider it “too old to insure.”

Most at risk:

Roofs 15–25+ years old

Homes with 3-tab asphalt shingles (most prone to wind/storm damage)

Properties in wind-prone areas (New Castle & Kent County)

Letters like these are being sent to homeowners across Delaware.

📉 2. The Hidden Policy Shift: How Coverage Changes Before You Even Get a Letter

Even if you haven’t received a letter from your insurance company warning about non-renewal, your policy could still be changing — quietly.

Many Delaware homeowners aren’t being dropped altogether… instead, their coverage is being reduced behind the scenes. Insurance carriers are switching homeowners with older or storm-worn roofs from full replacement coverage (RCV) to depreciated coverage (ACV) or fixed payout schedules (RSP) during their yearly renewal.

Sometimes, it’s not even presented as a choice — carriers simply inform homeowners that this is the only coverage now available for a roof of that age and condition.

These changes directly affect how much money you’ll receive if your roof is ever damaged — and how much you’ll need to pay out of pocket.

🔹 Replacement Cost Value (RCV) — The Full-Coverage Option

RCV is like having a safety net when your roof is damaged. It covers the full cost to replace your roof without factoring in age or wear and tear.That means if your roof needs replacing, your insurance pays enough to restore it to its original condition with new materials.

RCV policies usually come with higher premiums, but they offer peace of mind — you won’t face a huge, unexpected bill after a storm.

Example: A homeowner with an RCV policy replaced a $12,000 roof and only paid their deductible out of pocket. The rest was fully covered.

🔹 Actual Cash Value (ACV) — Depreciation Kicks In

ACV policies factor in depreciation, meaning your roof’s age and condition reduce your payout. The older your roof, the smaller the check.

While ACV policies often come with lower monthly premiums, they can cost you far more when it matters most.

Example: A 10-year-old roof with a $15,000 replacement cost might only get a $7,500 payout — leaving you to cover the remaining half.

🔹 Roof Surface Payment Schedule (RSP) — The New, Stricter Version

The Roof Surface Payment Schedule works a lot like ACV — but it removes any flexibility for condition. Instead of adjusting based on an inspection, insurers follow a pre-set table that dictates payout percentages strictly by roof age and material.

That means even if you’ve maintained your roof perfectly, your coverage is capped by the schedule — not your roof’s real condition.

In some ways, an RSP is even more limiting than ACV: keeping up with maintenance might help your roof last longer, but it won’t increase your claim payout.

These coverage changes often start gradually — a letter here, a policy update there — but by the time a homeowner files a claim, the shift has already cost them thousands.

Once your roof transitions to an ACV or RSP schedule, there’s no way back to full coverage until the roof is replaced.

💸 3. The Financial Reality: What These Policy Changes Mean for Your Wallet

A roof replacement is one of the biggest investments most homeowners will ever face — and your insurance policy determines whether that cost feels like a deductible… or a disaster.

The table below shows what a typical Delaware homeowner could expect under ACV and RSP Schedule coverage:

Roof Type | Replacement Cost | ACV (Depreciated) | RSP Schedule (Fixed %) | Homeowner’s Out-of-Pocket Cost |

Architectural Shingle (20-Year Roof) | $18,000 | $9,000 (50%) | $4,500 (25%) | $9,000–$13,500 |

3-Tab Shingle (20–25-Year Roof) | $15,500 | $7,750 (50%) | $3,875 (25%) | $7,750–$11,625 |

Figures based on average Delaware roof replacement costs and current industry payout models for roof age and coverage type.

🧾 What These Numbers Mean

Under an Actual Cash Value (ACV) policy, your payout decreases with your roof’s age and condition — meaning you’re responsible for whatever depreciation takes away.

With a Roof Surface Payment Schedule (RSP), it’s even stricter: the insurer uses a preset table that assigns a fixed percentage to your roof’s material and age. It doesn’t matter how well you’ve maintained your roof — a 20-year-old shingle roof is capped, often at 25–40% of its value.

That’s how a $15,000 roof replacement can turn into a $10,000+ personal expense, even after a legitimate wind or storm claim.

If your policy still provides Replacement Cost Value (RCV) coverage, your only out-of-pocket expense would typically be your deductible. But if you’ve been switched to an ACV or RSP plan, you can clearly see how quickly those costs start to climb.

🧩 Why This Matters

This is how insurance companies quietly reduce their financial risk — not by canceling policies outright, but by downgrading coverage on aging, storm-worn roofs. You remain “insured,” but the protection isn’t what it used to be.

Once that change takes effect, the next storm could leave you covering thousands more out of pocket than you ever expected.

💬 Real Example (from a Roof USA homeowner)

“When I filed my claim, I found out my policy had changed to an RSP plan. Instead of getting my full roof replaced, my insurance only covered 25%. I had to pay over $12,000 out of pocket. If I’d known sooner, I would’ve acted before the renewal.” — Bear, DE Homeowner, 2024 (Name redacted for privacy)

🌧️ 4. What “Storm-Worn” Really Means

Your roof doesn’t need to be falling apart to raise a red flag. Years of high winds, hail, and heavy rain wear down shingles in ways most homeowners can’t see from the ground.

“Storm-worn” roofs often show signs like:

Creased or flapping shingles

Loss of granules or bald patches

Brittle or curled shingle edges

Missing or lifted shingles near roof ridges

To your insurance company, this looks like risk — even if you haven’t filed a single claim.

🧩 5. What You Can Do Right Now

Whether your coverage has already changed or not, the best move is to get ahead of your insurer — before the next renewal or storm season hits.

✅ Step 1: Get a Free Roof Coverage & Condition Review

Roof USA offers no-cost roof inspections and estimates for Delaware homeowners. We’ll assess your roof’s current condition, identify any existing storm wear, and help you understand what your insurance policy actually covers. Knowing where you stand today could save you thousands later.

✅ Step 2: File While Full Coverage Still Applies

If your roof still qualifies for full replacement (RCV), Roof USA can help you document wind or storm damage, prepare your claim, and guide you through the entire process — ensuring your insurer pays what they owe. This step protects your investment and locks in your benefits before your coverage is downgraded.

✅ Step 3: Replace, Restore, and Recover Your Coverage

If your policy has already been switched to ACV or RSP, all is not lost. Replacing your roof now can reset your eligibility for full Replacement Cost Value (RCV) coverage going forward — restoring the protection your home deserves.

And if a reduced insurance payout leaves you facing a larger balance, Roof USA offers in-house, no-interest financing to help bridge the gap. Because we’re a local, family-owned company, we have the flexibility to work directly with our customers — offering competitive, transparent estimates that won’t break the bank.

🏠 About Roof USA

Roof USA is a local, family-owned roofing company based in New Castle, Delaware. We specialize in insurance-based roof replacements, helping homeowners navigate claims, protect their coverage, and ensure their homes stay fully insured.

We’re not just here to replace roofs — we help you understand your coverage and make smart, timely decisions.

📞 Call (302) 897-0542 or click below to schedule your Free Inspection & Roof Coverage Review.

Comments